Prepared by Chris Ryan, Flemings Property Services.

The NSW state parliament has given the go ahead on a move that is expected to increase homeownership rates in NSW.

From January 16th, 2023, we will see a major change to the way stamp duty if applied, known as the First Home Buyer Choice Bill.

Premier Dominic Perrottet announced on Thursday that the legislation was successfully passed through parliament, commenting “the changes will make the great Australian dream of home ownership much easier for a generation of young families”.

What is it?

The annual property tax presents an alternative to stamp duty, a long-criticised obstacle for people wishing to enter the property market.

This bill will give first home buyers, when buying a home up to the value of $1.5 million (while for the purchase of vacant land will be capped at $800,000), a choice between an upfront stamp duty payment or an annual property tax.

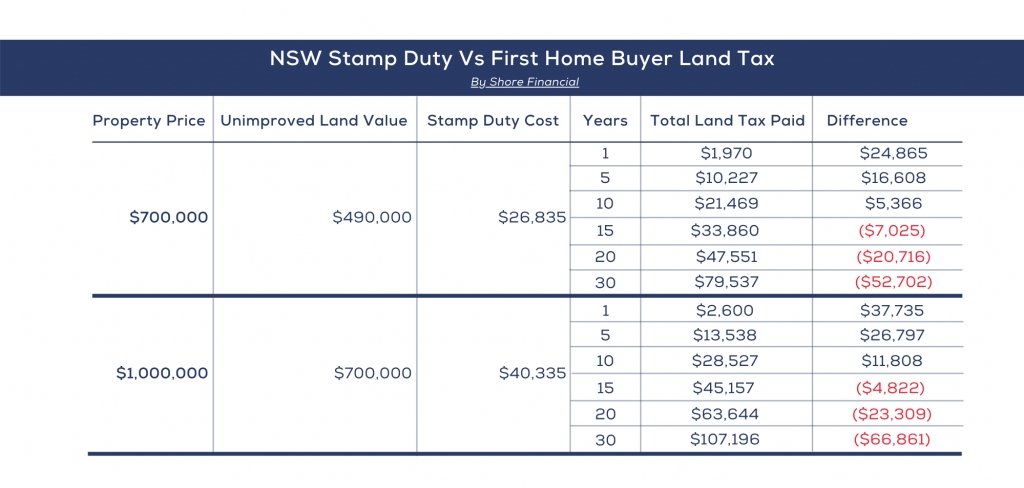

Property tax is calculated at $400 plus 0.3 per cent of the property’s land value.

When does it start?

January 16th, 2023.

First home buyers who purchase a property between now and January 16th, 2023, will be required to pay stamp duty with the option to apply for a refund next year.

Is the land property tax locked in forever?

If a first home buyer purchases a property under the new policy. and decides to sell, subsequent purchasers of that property will be required to pay stamp duty, unless eligible themselves.

Mr Matt Kean, (Hornsby—Treasurer, and Minister for Energy) addressed Parliament stating, “The property tax option is only available to first home buyers. Subsequent purchasers of a property will be required to pay stamp duty, as under current arrangements, unless they are themselves an eligible first home buyer and they choose to pay the property tax.”

What happens if I move out and the property becomes an investment?

This policy is designed and targeted to first home buyers trying to enter the property market. If you purchase a property (as an eligible first home buyer) and select to pay property tax, once you turn that property in to an investment, the scheme will change to; $1,500 plus 1.1per cent per annum.

As a comparison, Shore Financial has produced a graph comparing upfront stamp duty costs, and the annual land tax.

Speak to your local Flemings Property Services office today for further advice and assistance.